GST Registration

GST Registration for Business in India

Check if your compnay fall in any one of below

- Annual Turnover Exceeds Rs 20 / Rs 10 Lakhs

- Sales/Services outside State

- E-commerce Company

GST at a Glance

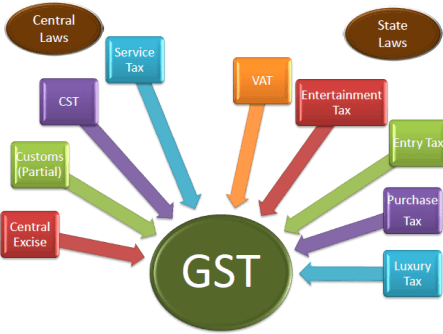

Goods and Services Tax is single tax combining VAT, CST, Service Tax, Excise duty, Entertainment Tax, etc and has been applicable all over India since 1 July 2017. Rates of GST varies between 0% to 28%.

Registration of GST is mandatory if,

- Annual turnover exceeds Rs. 20 Lakhs ( Rs. 10 Lakhs in case of North Eastern States)

- Sale of Goods or Services outside your own state ( Iner-state)

- Running E-commerce Company

However, any business can take voluntary registration and claim input tax credit on purchases or Services taken by filing return. Here we mean to say Tax Refund on Purchases or Service Taken.

GST Registration process is online and get temporary registration number immediate on successful application subject to verification by department. Registration number get permanent status along with Certificate within 3-4 days.

Send your Requirement here

Benefits of GST Registration

Claim Input Tax Credit (ITC) or Tax Refund

Only GST Registered entity can claim ITC or Tax Refund on goods purchase or Services taken

Apply for Tender

If you are intending to apply for Tender, most of the Company and Govt Department ask for GST Registration Certificate.

Enhance Business

Generally, MNC’s does not comfortable to deal with unregistered Business entity due to loss of ITC benefit.

Formal Business

With GST Registration, you can do formal business in India without any restriction and establishes your creditability.

Open Current Bank Account

Now a days Banks generally ask for GST registration number and certificate to open a current account.

Sale out of the State

With GST Registration, you can sale or provide services any state in India. Otherwise your business will be restricted within the state.